Tailored and Interactive Australian Tax Training for Generalist and Specialist Tax Professionals

Who is Tax Astute Training?

Tax Astute Training provides an innovative, modern and flexible approach to address your Australian Tax Training needs. We assist you to quickly and correctly understand complex tax concepts and apply them in practice using interactive Diagram Assisted Learning.

Established in 2010 by Heidi Rodgers, Tax Astute Training has operated nation-wide (and even internationally) to provide training to a wide variety of professionals who need to understand Australian Tax. Our clients include accountants, lawyers and financial planners, ranging from individuals to large firms and in-house corporate and family office teams.

Contact Tax Astute Training today and find out for yourself why we have a well-earned reputation as a premier Australian Tax Training organisation. See below for our forthcoming Group Training Events (including recent updates).

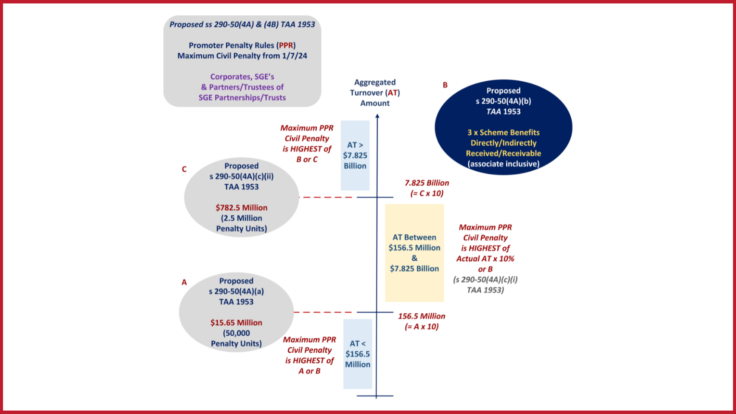

Training Video Example

Click the button below to see an animated online recording as a brief example of tax training featuring this diagram.

How Tax Astute Training helps you to better understand technical tax issues

It’s common knowledge that Australian Tax rules are both detailed and complex. We help you to learn, understand and correctly apply these rules in practice through the application of several key training principles. We strive to give you a professional advantage with Tax Astute Training.

-

- Tailored Topics – Our training seminars and events are tailored to your group’s specific needs. We tailor your seminars to include your group’s choice of topics and developments. Tax Astute Training operates comfortably at the daily cutting edge of Australian Tax changes and trends. We also offer training from our extensive library of well-established Feature Topics. Your training group may be your firm or team. If you work alone or in a very small team (or if you have specific tax specialist needs that vary from the rest of your team) we can offer access to merged groups of similarly qualified professionals.

-

- Interaction & Engagement – Our seminars are interactive, with regular question and answer segments. We encourage a back-and-forth discourse to keep you engaged. Your training presenter will also “check in” with you during live training sessions to ensure that you’re not “lost” along the way. Our post-session online recordings also include interactive quiz questions to maintain engagement and promote learning. Further, we use innovative methods to encourage technical questions to be posed to us from attendees of all knowledge levels (both during and after live training).

-

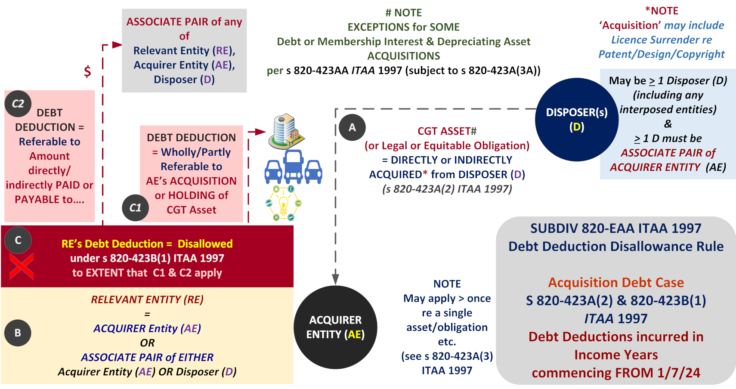

- Diagram Assisted Learning – Visual learning is widely recognised as an efficient and effective method of teaching complex concepts. We also understand that you don’t always have the time to read voluminous bodies of detailed text. We therefore take complex tax concepts, and detailed factual scenarios and convert them to more easily accessed and absorbed step-by-step animated flow-charts and diagrams. Your training presenter will speak to and lead you through these visual aids, at the appropriate pace for your group’s experience level and practice needs. It is our goal to analyse and interpret technical information and convert it into a format that assists you to better understand and apply it for your own practical purposes.

-

- Senior Presenter – All of your training sessions and events are planned and presented by a highly-regarded, senior tax professional with both accounting and legal qualifications and experience. Your presenter completely understands the technical subject matter and understands the need to be clear, precise, approachable and practical.

-

- Interactive Reference Materials – After your training session or event you can consolidate your newly acquired understanding with our handout notes (which include links to relevant online source materials) and our interactive online short-form recordings of the most important topics covered during your live training.

- CPD/CLE Tracking – Naturally, our training sessions and materials are designed to enable you to earn Continuing Professional Development / Continuing Legal Education hours.

Talk to us today about the professional advantage that Tax Astute Training can provide to you.

Training Video Example

Click the button below to see an animated online recording as a brief example of tax training featuring this diagram.

Please note that the Thin Capitalisation and Debt Deduction Creation Legislation was recently finalised on 27 March 2024 – see below on this page for forthcoming Group Training Events and other training options for understanding these and other complex new rules.